How ISA Data Cuts Fleet Insurance Costs

Dec 14, 2025 Resolute Dynamics

Running a fleet is not just about moving goods from point A to B. It’s about safety, compliance, and cutting unnecessary costs.

One of the biggest expenses for fleet operators is insurance. But what if the technology already inside your vehicles could help reduce those premiums?

Let’s talk about Intelligent Speed Assistance (ISA)—a powerful tool that not only improves road safety but also helps lower insurance costs by making your fleet less risky in the eyes of insurers.

Fleet Insurance in the Age of Data

Insurance companies are changing the way they price their policies. Instead of looking only at past claims or vehicle type, they now rely on real-time data.

That includes how fast your vehicles drive, how often they follow speed limits, and what kind of risky behaviors your drivers show.

This is where ISA and telematics step in. Fleet insurance is moving toward a usage-based model—and ISA data gives insurers the proof they need that your drivers are safe, compliant, and less likely to cause an accident.

What is Intelligent Speed Assistance (ISA)?

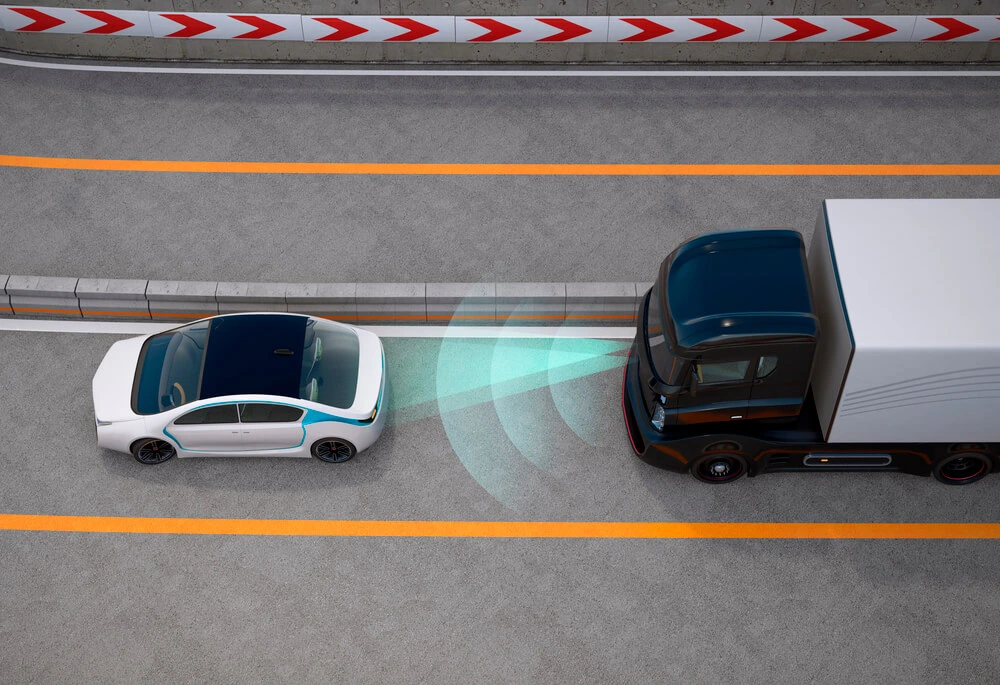

ISA is a smart vehicle system that helps drivers follow speed limits automatically. It uses GPS data, digital maps, and onboard cameras to check the road’s speed limit. If the vehicle goes over the limit, ISA can warn the driver, or in some cases, slow the vehicle down.

Some versions are passive—just alerting the driver. Others are active—reducing throttle power to stay within limits. In 2022, the EU made ISA mandatory for new cars, and many other countries, including those in the MENA region, are exploring similar rules.

Fleet operators using ISA systems are ahead of the curve. They’re safer, more compliant, and already aligned with future legal requirements.

What Kind of Data Does ISA Collect?

Intelligent Speed Assistance (ISA) doesn’t just help drivers stay within the speed limit — it also collects critical data that paints a full picture of how safely your fleet is operating.

Here’s the core data it gathers:

1. Speed vs. Legal Limit

The system constantly compares the vehicle’s current speed to the posted road speed limit. This real-time comparison shows exactly when, where, and how long a vehicle is speeding.

2. Location and Time of Violations

ISA logs the GPS coordinates and timestamp of every speeding incident. This helps identify risky zones (like accident-prone highways) and times (such as peak traffic hours or late-night driving).

3. Driver Behavior Patterns

Over time, ISA systems collect behavior trends — such as:

-

Which drivers tend to speed frequently

-

How quickly they respond to ISA alerts

-

How driving habits change with feedback

This data becomes a behavioral profile for each driver, which is valuable for coaching and risk reduction.

How ISA Data Becomes Actionable

When ISA integrates with real-time fleet connectivity and telematics platforms, the data turns from raw information into actionable intelligence.

Fleet managers can instantly track driver behavior, fuel efficiency, and compliance levels—all in one dashboard. This level of visibility empowers teams to reduce risk, cut costs, and strengthen relationships with insurers who value transparent data reporting.

Once integrated, you can:

-

Rank drivers by safety score or compliance rate

-

Identify problem areas like routes or locations where most violations occur

-

Monitor fleet-wide trends, helping managers make smarter decisions

This helps with proactive intervention—before risky driving leads to accidents or fines.

Working with Other Fleet Tech

ISA rarely works alone. It often pairs with other in-vehicle systems to form a complete safety picture:

ADAS (Advanced Driver Assistance Systems):

Detects lane drifting, fatigue, tailgating, or harsh braking — adding context to ISA data.

Dashcams:

Provide visual evidence of what happened during a speeding event or incident.

Black Boxes / Event Data Recorders:

Securely store data that can be used for insurance claims, audits, or training.

Together, these tools turn raw speed data into insightful, trusted information for insurers and fleet owners alike.

Why Do Insurers Trust ISA Data?

Insurance companies rely on data to assess risk, set premiums, and determine liability. ISA data is trusted because it’s accurate, real-time, and nearly impossible to manipulate — unlike manual logs or driver testimonies.

Real-Time, Reliable, and Objective

ISA pulls data directly from the vehicle’s systems — including speed, location, and compliance with road limits — using onboard sensors, GPS, and smart mapping. This means:

-

It’s not based on opinion or memory

-

There’s no delay in reporting behavior

-

It gives factual, time-stamped evidence

This kind of verified, machine-captured data gives insurers confidence in assessing how safely a fleet operates.

Lower Risk, Fewer Claims

When insurers see consistent ISA data across a fleet, they recognize patterns that indicate lower risk, such as:

-

Fewer instances of speeding

-

Drivers reacting to warnings correctly

-

Reduced exposure to high-risk behavior

This directly translates into:

-

Fewer accidents

-

Lower claim payouts

-

Better safety reputation for the fleet

Useful for Dispute Resolution

In case of an accident, ISA logs can act as digital proof of compliance:

-

Showing the driver stayed within speed limits

-

Backing up your version of events

-

Avoiding false claims or unnecessary liability

This makes ISA not just a safety tool, but a legal safeguard.

Why This Leads to Lower Premiums

ISA Builds a Safer, More Insurable Fleet

Insurance companies care about one thing: risk. The safer your fleet behaves, the less likely it is to file claims — and that’s where Intelligent Speed Assistance (ISA) makes a huge difference.

ISA helps create a strong risk profile, which is a record of how safe and reliable your vehicles and drivers are. The better the profile, the lower the insurance premium.

Fewer Speeding Events = Fewer Crashes

Speeding is a top cause of road accidents. When your vehicles consistently stay within speed limits — thanks to ISA alerts or automatic speed control — the chances of a crash drop sharply.

Over time, this means:

-

Fewer accident-related insurance claims

-

Less vehicle downtime and repair costs

-

A safer reputation for your brand

This positive history gives insurers confidence in your fleet’s risk level.

Improved Driver Scores

ISA tracks how often drivers speed and how quickly they respond to warnings. These insights feed into driver performance scores, which are often shared with insurance providers.

Benefits of high-scoring drivers include:

-

Access to driver-based insurance pricing

-

Incentives like lower deductibles or bonuses

-

Easier identification of who needs retraining or rewards

A fleet full of high-performing drivers tells insurers that safety is taken seriously.

Policy Discounts for High-Compliance Fleets

Insurance companies often offer usage-based discounts or custom pricing to fleets that share safety data. With ISA, you can prove:

-

High speed compliance rates

-

Ongoing monitoring and driver accountability

-

Use of advanced safety technology

These factors can qualify your fleet for negotiated premiums, bonus discounts, or better terms over time.

Safer Driving = Real Savings

example –

Let’s say a logistics company installs ISA across its fleet. Within six months:

-

Speeding events drop by 25%

-

Drivers respond faster to alerts

-

Claims decrease significantly

As a result, their insurer reviews the data and offers a 15% discount on their renewal quote — simply because the fleet now presents less risk.

Compliance, Safety, and Legal Protection

Governments around the world are getting stricter about speed compliance. UAE’s RTA, for example, is pushing for smarter fleet systems that can help meet road safety goals.

ISA helps with:

-

Automatic compliance with local speed laws

-

Fewer violations, saving money on tickets

-

Stronger defense in case of accidents or lawsuits

Being proactive with safety also shows clients and partners that your company takes responsibility seriously. That’s a big plus in competitive markets.

How Resolute Dynamics Makes ISA Work for You

At Resolute Dynamics, ISA isn’t just a tool—it’s part of a complete safety ecosystem. Our platform connects ISA data with:

-

AI-powered vision systems for fleets that detect road signs, lane drift, and driver fatigue in real time—feeding accurate visual intelligence into ISA’s decision-making process for safer and smarter journeys.

-

Telematics dashboards (to track performance in real-time)

-

Speed control modules (to ensure safe driving automatically)

This system is designed to capture, connect, and control everything that affects fleet safety. And all this works across urban roads, highways, and even off-road terrains in places like the UAE, India, and Southeast Asia.

With over 200,000 connected vehicles and clients in 20+ countries, Resolute Dynamics is trusted to turn data into real-world results.

How to Choose the Right ISA Partner

If you’re ready to adopt ISA, here’s what to look for:

-

Real-time data visibility

-

Accurate GPS + camera integration

-

AI features to predict risky behavior

-

Easy integration with existing fleet software

-

Proof of regulatory compliance

Make sure your provider can support your insurance goals, not just your safety ones. ISA should be part of your business strategy, not just a tech add-on.

Final Thoughts: ISA is an Investment, Not an Expense

ISA data does more than just keep your vehicles within the speed limit. It gives you:

-

Lower insurance premiums

-

Safer roads for your drivers

-

Better reputation as a responsible fleet operator

-

Protection from legal and regulatory trouble

In the long run, ISA pays for itself—not just in reduced premiums, but also in lives saved, claims avoided, and business won through higher trust.

If you’re not using ISA yet, now is the time to act. Safety and savings go hand in hand—and ISA is the key that unlocks both.