How Telematics Is Changing Fleet Insurance Forever

Dec 17, 2025 Resolute Dynamics

Commercial fleet insurance isn’t what it used to be. Not long ago, insurers mostly relied on past claims, vehicle type, and driver age to set premiums. But today, with the rise of connected vehicles and smart sensors, there’s a much better way: telematics data.

Fleet insurance is moving from guesswork to data-driven decisions. This change helps both insurance companies and fleet operators make smarter choices. Telematics gives everyone a clearer picture of how vehicles are being used — in real time.

Key Telematics Metrics Used in Underwriting

Insurance companies no longer rely solely on historical claims or broad risk categories. Instead, they now use real-time telematics data to make smarter and fairer underwriting decisions.

These key metrics help them understand how fleets actually operate on the road.

1. Driving Behavior Analysis

Telematics systems track how drivers behave behind the wheel. Sudden braking, sharp acceleration, hard cornering, and tailgating are all red flags. These behaviors raise the likelihood of collisions and vehicle wear.

Each driver can be scored using driver performance metrics, which underwriters use to assign a risk level. A consistent pattern of safe driving can lead to lower premiums, while risky habits may trigger higher insurance costs.

2. Vehicle Usage Patterns

How a fleet is used matters. Vehicles that clock high mileage, operate on rough terrains, or idle for long periods are more likely to experience mechanical failure or incidents.

Insurers analyze metrics like:

-

Distance traveled per day

-

Vehicle idle time

-

Engine run-time duration

This helps determine wear-and-tear risk, fuel efficiency, and even carbon footprint — all useful for assessing operational risk.

3. Speed Compliance Monitoring

Speeding is one of the top contributors to road accidents. Telematics tracks how often a driver exceeds posted speed limits, by how much, and under what conditions.

Insurers can compare this data with local traffic laws using geo-speed mapping. Fleets that stay within legal limits show lower risk behavior — a valuable indicator when pricing policies.

4. Geolocation & Route Risk Exposure

Where a vehicle operates is just as important as how it’s driven. Telematics tools use GPS data to track the geographical risk environment.

Routes through high-traffic zones, accident-prone areas, or poorly maintained roads raise exposure to potential claims. Using route analytics, insurers can adjust risk levels based on environmental factors such as urban density, road infrastructure, and even weather zones.

5. Time-of-Day Travel

When a vehicle is on the road can greatly influence risk. Driving during:

-

Late night hours (reduced visibility, fatigue risk)

-

Early morning (high congestion)

-

Weekend nights (higher drunk-driving rates)

…all carry different levels of exposure. Telematics records time-stamped trip data, helping insurers assess temporal risk factors and reward fleets that avoid high-risk time periods.

How Telematics Enhances Insurance Underwriting

Telematics has changed the way insurers assess, price, and manage risk. Instead of depending only on past claims or static data, underwriters can now tap into real-time, behavior-based insights.

This leads to faster decisions, fairer pricing, and better risk management for fleets.

Real-Time Risk Assessment

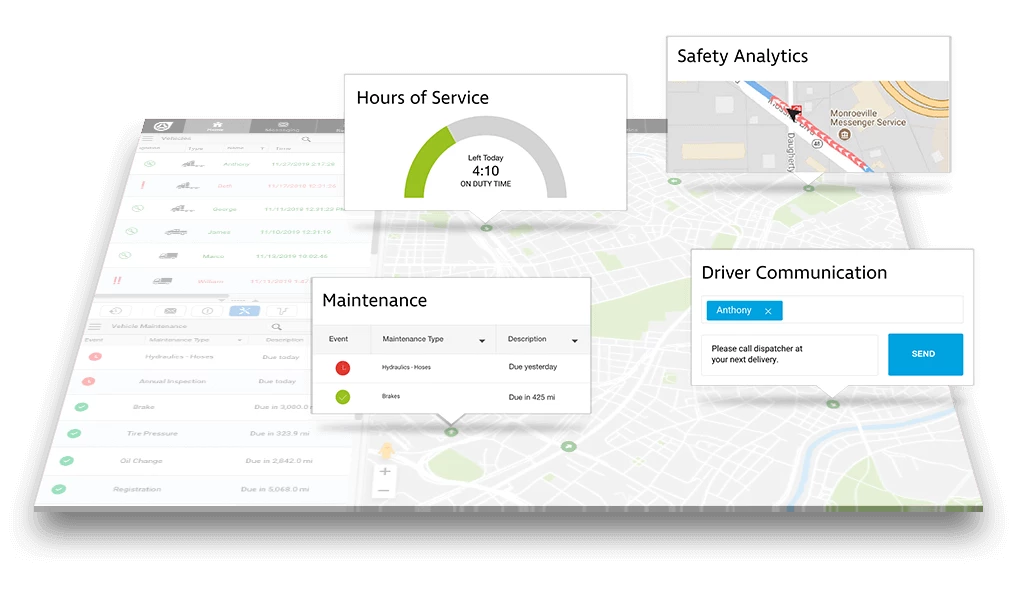

With telematics, insurers don’t have to wait for an accident report to assess risk. They can monitor driver behavior, vehicle health, and road conditions in real time.

Our AI-powered telematics and data intelligence platform enables this proactive approach—delivering live, high-fidelity insights that help insurers and fleets identify risk early, improve decision-making, and enhance operational transparency.

This allows them to:

-

Flag risky behavior before it results in a claim

-

Recommend early interventions (e.g., coaching for harsh driving)

-

Make quicker, data-backed underwriting decisions

Live risk scoring is becoming a core part of modern fleet insurance platforms.

Dynamic Pricing (Usage-Based Insurance)

Traditional insurance uses fixed premiums, but telematics supports usage-based insurance (UBI). This means:

-

Premiums reflect actual vehicle use and driver behavior

-

Safe drivers and well-managed fleets pay less

-

Policies can adapt over time based on performance

Dynamic pricing makes insurance more personalized and performance-driven, giving operators more control over their costs.

Fraud Detection and Prevention

Telematics data acts as a digital witness. It provides:

-

Time-stamped trip logs

-

Vehicle speed and location data

-

Driver activity reports

This makes it much harder to fake accident claims or exaggerate damage. In disputed cases, insurers can use the data to verify the facts, reducing insurance fraud losses.

Better Risk Segmentation

Instead of rating all drivers or vehicles the same, underwriters can now evaluate:

-

Individual driver risk profiles

-

Vehicle-specific usage patterns

-

Operating environments (urban vs. rural, day vs. night)

This granular segmentation allows for more accurate premium models. Low-risk drivers aren’t punished for others’ mistakes, and high-risk patterns can be addressed proactively.

Benefits for Fleet Operators

Telematics doesn’t just help insurers — it gives huge advantages to fleet owners too:

✔ Lower Insurance Premiums

Safe fleets often get discounts. Insurers reward good driving behavior with better pricing.

✔ Safer Roads

By tracking behavior, fleet managers can spot risky drivers and offer training. This helps prevent accidents before they happen.

These results are amplified through intelligent speed governance and vehicle control solutions that automatically manage speed, braking, and stability—reducing human error and reinforcing safer driving habits across entire fleets.

✔ Regulatory Compliance

In many regions, like the UAE, MENA, and Asia, there are strict safety and environmental rules. Telematics makes it easier to follow these rules and avoid fines.

✔ Operational Efficiency

By knowing how vehicles are used, companies can reduce fuel waste, improve routes, and schedule maintenance before breakdowns happen.

Challenges & Considerations for Adoption

While the benefits are big, there are some roadblocks to using telematics for insurance underwriting:

-

Privacy Concerns: Some drivers worry about being tracked too closely. Companies must be clear about how data is used.

-

Integration: Not all insurers and fleets use the same systems. It can be hard to sync data across platforms.

-

Data Overload: Too much raw data can be overwhelming. What matters is turning that data into clear insights.

Why Resolute Dynamics is Pivotal in This Shift

Resolute Dynamics are leading the charge. With over 200,000 connected vehicles and presence in 20+ countries, our tech is helping insurers and fleet managers create safer roads.

Resolute’s systems:

-

Use AI-powered vision to detect unsafe behavior

-

Collect real-time data for instant decision-making

-

Help fleets stay compliant and reduce operating costs

-

Provide data that’s accurate, secure, and scalable

For any insurance company or fleet operator wanting to stay ahead, partnering with a trusted telematics provider is no longer optional — it’s essential.

Conclusion: A Safer, Smarter Way Forward

Telematics is more than just tracking. It’s the engine behind a smarter, safer, and fairer insurance system. With data-driven insights, insurers can underwrite policies more accurately, and fleets can drive down costs while improving safety.

As technology continues to evolve, those who embrace it now will be the ones who lead tomorrow.